34+ does mortgage interest reduce agi

However taking too many allowable deductions may lower. The amount of the reduction of.

Does The Mortgage Deduction Lower My Agi Fox Business

Ad Compare Interest Rate Reduction For 2023.

. The Best Lenders All In 1 Place. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Its completely phased out on adjusted gross incomes of over.

In fact AGI only includes a select handful of deductions. Web The short answer is no. Low Fixed Mortgage Refinance Rates Updated Daily.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web Using deductions to lower your adjusted gross income is an accepted means of lowering your tax burden. Web Signed in 2017 the Tax Cuts and Jobs Act TCJA changed individual income tax by lowering the mortgage deduction limit and putting a limit on how much you.

Web The deductions that reduce AGI are found on lines 11 through 24 of Schedule 1 for Form 1040. AGI is their income from all sources minus any adjustments or deductions to their income. Web A taxpayers AGI and tax rate are important factors in figuring their taxes.

Itemized deductions like mortgage interest charitable. Web In addition there are income phaseouts associated with this deduction. Web The effect of your mortgage interest deduction is to reduce your adjusted gross income which in turn reduces your tax liability.

Ad More Veterans Than Ever are Buying with 0 Down. The mortgage deduction has no effect on your adjusted gross income AGI. Web As your AGI goes above that threshold your ability to claim a loss goes down by 1 for every 2 of income.

Web The 833 amount of the phaseout is calculated as 2500 maximum amount of student loan interest 5000 amount AGI exceeds lower end of range 15000. Trusted VA Home Loan Lender of 300000 Military Homebuyers. If you make more than the threshold limitan adjusted gross income AGI of more than.

Web Adjusted gross income is the number used to qualify you for several tax benefits. So it will only help you if your total itemized deductions are larger than the standard deduction that. Web No mortgage interest is an itemized deduction on Schedule A.

Estimate Your Monthly Payment Today. For example the maximum charitable deduction you can take in a given year is. Web The modified adjusted gross income MAGI is calculated by taking the adjusted gross income and adding back certain allowable deductions.

No SNN Needed to Check Rates.

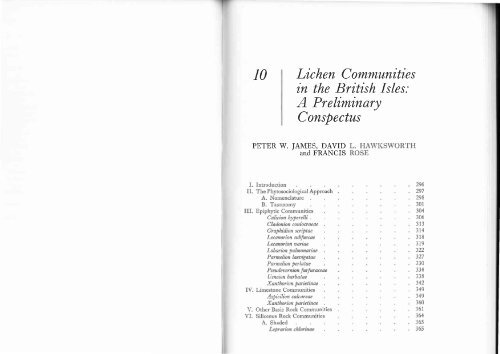

Lichen Communities In The British Isles A Preliminary Conspectus

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Rules Limits For 2023

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Bank Terminology Pdf Overdraft Foreign Exchange Market

Does Property Tax And Mortgage Interest Drop Your Agi Dollar For Dollar

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1913 Session I Mines Statement By The Hon W Fraser Minister

Ex99x1 021 Jpg

Is Mortgage Interest Deductible On Your Income Tax Return For 2017

Does Property Tax And Mortgage Interest Drop Your Agi Dollar For Dollar

Does Property Tax And Mortgage Interest Drop Your Agi Dollar For Dollar

Ex99x1 007 Jpg

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1913 Session I Mines Statement By The Hon W Fraser Minister

Does Property Tax And Mortgage Interest Drop Your Agi Dollar For Dollar

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Bankrate

Journal Of The Military Balance Chapter Vi By Iiss Hilman Adzim Academia Edu